Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

THE ROLE OF PUBLIC PRIVATE PARTNERSHIP IN BUSINESS DEVELOPMENT

Annotation. Developed countries agree that the development of public-private partnerships is one of the new ways for countries to achieve economic growth,, business development, infrastructure development, and better public services. The results of successful PPP projects around the world have also put developing countries in need of introducing the PPP model. Georgia is one of these countries, but without the necessary institutional, political and legal environment for such a partnership in the country, it will be quite difficult to successfully implement successful PPP projects.

Keywords: PPP, government and PPP, business and PPP

The Public-Private Partnership Model (PPP) is a state-to-business partnership aimed at implementing important political and social projects at the national, regional and local levels. With the Public-Private Partnership model, which involves joint projects developed by business and the state, many areas have been developed around the world in education, healthcare, infrastructure and other important sectors. PPP projects are useful and therefore a priority for the state, as in the case of insufficient capital to implement public projects, most of the costs are covered by the private sector (60-40%).

The goal of the private sector in entering into a PPP is to profit from its capacity and experience in managing businesses (utilities in particular). The private sector seeks compensation for its services through fees for services rendered, resulting in an appropriate return on capital invested (Public Private Partnership handbook, p.9)

Тhe government may decide to enact a PPP law or a concession law for a number of reasons, such as to give priority to a process of developing, procuring and reviewing PPP projects that will take priority over sector laws, or to establish a clear institutional framework for developing, procuring and implementing PPPs. PPP laws can also be used to close gaps in the laws of a host country may need to allow for successful infrastructure PPP projects, such as enabling the grant of step-in rights to lenders and requiring open and fair procurement processes. These modifications may be embodied in sector-specific law, or in the case of procurement, a procurement or competition law, or it can be included in a general concession or PPP law.

While guidance and examples can be useful, each PPP/ concession law needs careful drafting to be consistent with the host country's existing laws. Legal draftsmen need to strike a balance between setting ground rules that encourage transparency and imposing general restrictions that may hinder bidding teams from achieving value for money or sensible solutions when bidding out PPP projects (World Bank Group).

Most of the countries have regulations for PPP, for the example we have chosen five countries:

Table 1. Countries and PPP regulations

Source: author according to World Bank Public-Private Partnership laws

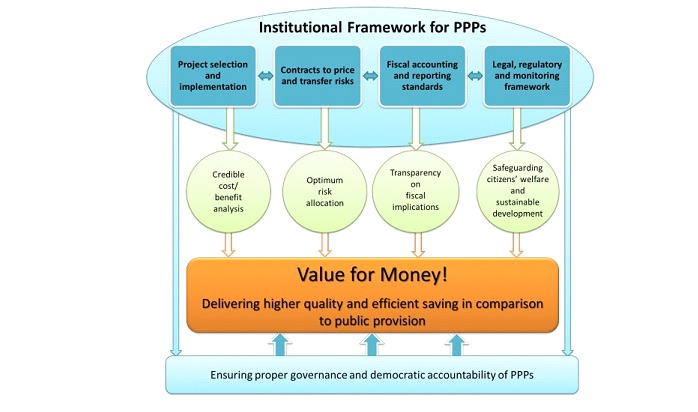

Scheme 1. Key components of an enabling institutional framework for PPPs

Source: Public-Private Partnerships and the 2030 Agenda for Sustainable Development: Fit for purpose?

Georgia is one of the new countries in this area, reflecting an increased willingness to implement PPPs. International agencies are financing various programs to help the government improve fiscal management, including improvements to capital markets which will help to mobilize more long-term finance and encourage PPPs. However, an inadequate concession law, weak coordination and oversight as well as limited experience are some of the challenges faced by the country (PPP standards).

PPPs have not been a priority and over the last decade most infrastructure has been developed either through full privatization or traditional public procurement funded by overseas development agencies. The 1994 concession law makes no mention of institutional arrangements, risk allocation guidelines or procurement. PPPs are therefore largely governed by general public procurement and investment laws, the Civil Code, and where relevant by sector specific regulations. Financial commitments by the government must comply with the Budgetary Code and annual state budget requirements, but these regulations have not been adapted to deal with liabilities in the context of government support to long term PPPs. There is no defined process for choosing a PPP over other procurement modes. Ministries are in charge of setting the long-term policy direction in their sectors (not specific to PPPs), and either procuring authorities or external donors establish criteria for project identification and evaluation. The public procurement law establishes a transparent, non-discriminatory bidding process. In practice, Georgia’s track record for transparency is not strong, but has improved somewhat with the introduction of an e-procurement and tracking system (PPP standards).

A strong PPP allocates the tasks, obligations, and risks among the public and private partners in an optimal way. The public partners in a PPP are government entities, including ministries, departments, municipalities, or state-owned enterprises. The private partners can be local or international and may include businesses or investors with technical or financial expertise relevant to the project. Increasingly, PPPs may also include nongovernment organizations (NGOs) and/or community-based organizations (CBOs) who represent stakeholders directly affected by the project (Public Private Partnership handbook, p.7).

Table 2 Differing conceptualizations of public-private partnerships

|

Definition |

Dimension |

|

An arrangement between two or more entities that enables them to work cooperatively towards shared or compatible objectives and in which there is some degree of shared authority and responsibility, joint investment of resources, shared risk taking, and mutual benefit (HM Treasury 1998) |

Inter-organizational relationship; Cooperation; Shared objectives; Joint investments; Risk sharing; |

|

Public-private partnerships are on-going agreements between government and private sector organizations in which the private organization participates in the decision-making and production of a public good or service that has traditionally been provided by the public sector and in which the private sector shares the risk of that production (Forrer et al. 2010). |

Risk sharing; Inter-organizational relationship; |

|

A legally-binding contract between government and business for the provision of assets and the delivery of services that allocates responsibilities and business risks among the various partners (Partnerships British Columbia, 2003) |

Contractual governance; Risk allocation; |

|

The main characteristic of a PPP, compared with the traditional approach to the provision of infrastructure, is that it bundles investment and service provision in a single long-term contract. For the duration of the contract, which can be as long as twenty or thirty years, the concessionaire will manage and control the assets, usually in exchange for user fees, which are its compensation for the investment and other costs. (Engel et al., 2008) |

Bundling; Service provision; Long-term contract; |

|

Partnerships which include contractual arrangements, alliances, cooperative agreements, and collaborative activities used for policy development, program support and delivery of government programs and services (Osborne 2000) |

Contractual governance; Inter-organizational relationship; |

|

A relationship that consists of shared and/or compatible objectives and an acknowledged distribution of specific roles and responsibilities among the participants which can be formal or informal, contractual or voluntary, between two or more parties. The implication is that there is a cooperative investment of resources and therefore joint risk-taking, sharing of authority, and benefits for all partners (Lewis 2002) |

Inter-organizational relationship; Shared objectives; Mutual investments; Risk sharing; Benefit sharing; |

|

A relationship involving the sharing of power, work, support and/or information with others for the achievements of joint goals and/or mutual benefits (Kernaghan 1993) |

Inter-organizational relationship; Cooperation; Power and information sharing; Shared objectives; |

Source: Roehrich et al (2014)

The public-private partnership is also defined as a form of full-fledged replacement for privatization programs that allows the state to maintain control functions in the socially important sectors of the economy and in strategic sectors.

Principles of Public-Private Partnership:

- People First - core principle of the PPP model is to be beneficial for the society. Interests of the private sector are not the priority. Citizens should gain access to the high-quality services while having fewer expenses.

- Government’s Ability to retain ownership of the assets

- Equal distribution of responsibilities and functions between the parties- Private and Public sectors are expected to equally be responsible for resources, decision-making, risk management and number of other functions.

- Both parties should have equal rights in the partnership.

- Concession agreements— Private Sector should be granted the right to operate, maintain and carry out investment in a public utility

- Transparency- Society and Media should be informed about the details of the project (financing, quality) and the members of consortium,

- Supplying citizens with the services by the agreement deadline

- Common interest of both parties (The center of public private partnership 2020)

Benefits of PPP:

- People First

- Cost-effectiveness

- Economic growth

- Attracting investors- Businesses are attracted to areas with new and stable infrastructure.

- Quality and service improvement

- High service availability

- Creating new jobs

- Retention of workforce –Retaining the existing workforce presents opportunities for it to participate in knowledge and skills transfers, as well as learn new technologies.

- Investment in new technology – Part of the upgrades and repairs to systems include new technology, which can improve the quality of the service.

- Ability to retain ownership of the assets –With public-private partnerships that incorporate a concession model, ownership can remain with the community.

- Value for Money - Extracting long-term value-for-money through appropriate risk transfer to the private sector over the life of the project – from design/ construction to operations/ maintenance

- Upfront capital – Many concession models involve an upfront capital infusion to the municipality. This cash can be used on a variety of municipal needs and can help relieve financial pressures on other departments.

- Relief of financial stresses – There are many pension liabilities and health care expenses that are legacy costs that cities struggle to pay. In some PPP arrangements, these can be taken over by the private entity (The center of public private partnership 2020).

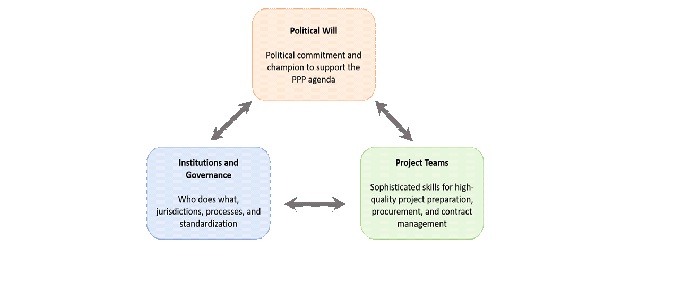

A healthy Public-Private Partnership (PPP) has several defining features: strong competition, bankability with low financial costs, lower risk of renegotiations, secure value for money, and efficiency gains. There are suggested three institutional pillars are needed to increase the probability of PPP success by Flor L, at the world bank blog.

Scheme 2. Three pillars to increase the PPP success

Source: Three ways governments can create the conditions for successful PPPs

The three main needs that motivate governments to enter into PPPs for infrastructure are: 1. to attract private capital investment (often to either supplement public resources or release them for other public needs); 2. to increase efficiency and use available resources more effectively; and 3. to reform sectors through a reallocation of roles, incentives, and accountability (Public–Private Partnership Handbook. Asian Development bank p.8)

Sectors in which PPPs have been completed worldwide include:

- power generation and distribution

- water and sanitation

- refuse disposal

- pipelines

- hospitals

- school buildings and teaching facilities

- stadiums

- air traffic control

- prisons

- railways

- roads

- billing and other information technology systems

- housing

As it is given around the world PPP projects are in private sector es well as in the state projects too. PPPs are aimed at increasing efficiency of infrastructure projects by means of a long-term collaboration between the public sector and private business. This holistic approach extends over the entire lifecycle (Different models of PPP).

Conclusion

A successful public-private partnership largely depends on the ability of the government to secure the performance of the contract. This includes setting clear requirements for the partnership, monitoring the work of all parties to the contract, and enforcing the provisions of the contract that are not being fulfilled yet. As the study shows, in the still PPP is not as popular in Georgia as in other countries and there should be done a lot, because the successful PPP gives benefits to the private sector as well as to the government. Business should be developed in the framework of PPP, which are already implemented in various countries and necessary for Georgia too.

References

- Different models of PPP. https://ppiaf.org/sites/ppiaf .org/files/documents/toolkits/ Cross-Border-Infrastructure-Toolkit/ Cross-Border%20Compilation% 20ver%2029%20Jan%2007 /Session%204% 20-%20Private%20Sector% 20Participation/Private%20Sector_02%20Diferent% 20Models%20of%20PPP% 20-%2029%20Jan%2007.pdf

- Engel E, Fischer R and Galetovic A, (2008). “Public-Private Partnerships: When and How”. http://www.econ.uchile. cl/uploads/publicacion /c9b9ea69d84d4c937 14c2d3b2d5982a5ca0a67d7.pdf.

- Forrer J, Kee J, Newcomer K, and BoyerForrer E, (2010). “Public-Private Partnerships and the Public Accountability Question”. Public Administration Review, Vol. 70, pp. 475-484

- HM Treasury, (1998). Partnerships for Prosperity: the Private Finance Initiative. HM Treasury, London.

- Kernaghan K, (1993). “Partnerships and Public Administration: Conceptual and Practical Considerations”. Canadian Public Administration. Vol. 361, pp. 57-76.

- Lewis M, (2002). “Risk Management in Public-Private Partnerships”. Working Paper. School of International Business, University of South Australia.

- Osborne S, (2000). Public-Private Partnerships: Theory and Practice in International Perspective. Routledge, London

- Partnerships British Columbia, (2003). An Introduction to Public Private Partnerships. Update June 2003. Partnerships British Columbia

- Public-Private Partnership laws. https://ppp.worldbank .org/public-private- partnership/l egislation-regulation/laws/ppp- and-concession- laws#examples

- Public-Private Partnerships and the 2030 Agenda for Sustainable Development: Fit for purpose? https://www.un.org/esa/ desa/papers/2016/wp 148_2016.pdf

- Public–Private Partnership Handbook. Asian Development bank. https://www.adb.org/sites/ default/files/institutional-document/ 31484/public-private-partnership.pdf

- PPP standards. http://pppstandards.org/georgia/

- Jens K.R. Lewis M.A, Gerard G, 2014. “Are Public-Private Partnerships a Healthy Option? A systematic Literature Review”, Social Science & Medicine 113 (2014), pp. 110-119

- The center of public private partnership 2020. http://ppp.ge/

- Three ways governments can create the conditions for successful PPPs. https://blogs.worldbank.org/transport/three-ways-governments-can-create-conditions-successful-ppps

- World Bank Group. https://ppp.worldbank. org/public-private- partnership/legislation-regulation /laws/ppp-and- concession-laws